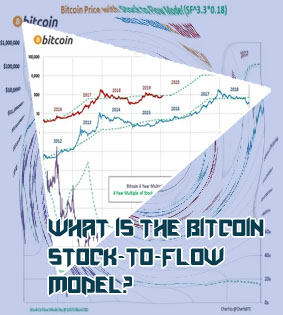

Btc stock to flow

The Stock to Flow Model Meets Bitcoin

The stock-to-flow value of an asset like BTC shows how scarce it is. The model relates this value with the price and gives a prediction based on that. Btc stock to flow model According to this method, the SF of Gold is 62, which means that it will take 62 years to produce the current gold stock. This is the highest stock to flow ratio amongst all commodities, and it can fluctuate with time. When the gold price is higher, its mining is more viable, which incentivizes more mining and increases the flow of gold into the market, decreasing its S2F ratio. Alternately, when the price of gold is low, its mining isn’t as viable, reducing its production rate. As the flow of gold decreases, its S2F ratio shoots up again.

Bitcoin stock to flow live

PlanB, the infamous creator of the stock-to-flow (S2F) model for Bitcoin, has seemingly abandoned the HODL strategy in favor of “quant investing” through ByBit. ImmutableX Makes Noise As IMX Dominates Top 50 Roster With 33% Climb The concept of stock-to-flow has found particular relevance in the world of cryptocurrencies, especially in the case of Bitcoin. This is because Bitcoin's supply is predetermined and capped at 21 million coins. With a fixed supply schedule and a known issuance rate through mining, Bitcoin's stock-to-flow ratio has been increasing over time.

Tether acquires 20% stake in German Bitcoin miner Northern Data in unusual equity deal: Report

By proxy, these updated, ‘on-the-spot’ valuations for gold and silver provide further validation for other predictions made by the Stock to Flow model. And this is where it goes from ‘good’ to ‘possibly incredible’ for Bitcoin. Come the next halving, Bitcoin’s Stock-to-Flow ratio will raise from around 25 at the moment, to approximately 54 - a hair below that of gold’s current SF ratio of 62. Stock-To-Flow Creator “Relieved” After Bitcoin Price Plummets Below Trajectory More recently, the 20- and 50-period weekly moving averages staged a bullish cross, as the shorter-period MA moved above the longer. Historically, Bitcoin’s price has continued to form new local highs during this event, further confirming a long-term positive trend.

Stock to flow chart bitcoin

Pseudonymous peddler of Bitcoin’s “stock-to-flow” price model PlanB pledged to invalidate his projection if BTC would not reach $100,000 by December 2021. How Bitcoin's Scarcity Affects the Stock-to-Flow Model Presently, Bitcoin has the highest S2F of 66. Now, since Bitcoin shares strong analogies with Gold and Bitcoin’s issuance is a near-absolute certainty, PlanB explained that it is inevitable that Bitcoin would be valued above $10o,000 between 2022 and 2025, according to his calculations. Therefore, the co-integration of price and S2F suggested that in the long-term, they will not deviate significantly.